Virtual Terminal

Virtual Terminal

The Virtual Terminal is a major feature of your Authorize.Net eCommerce Payment Gateway and is basically an online credit card terminal for “key entering” transactions. The Virtual Terminal allows you to manually submit Credit Card or eCheck transactions to the Authorize.Net Gateway through a PC or Laptop.

- Virtual Terminal– Virtual Terminal provides the best solution for merchants who manually enter credit card and electronic check transactions for mail order/telephone order (MOTO) sales.

- Batch Upload– Submitting multiple transactions in a single file is an efficient way to upload credit card and electronic check transaction data from enterprise applications or other file-based systems.

To enter a new transaction using Authorize.Net’s Virtual Terminal from your PC or Laptop:

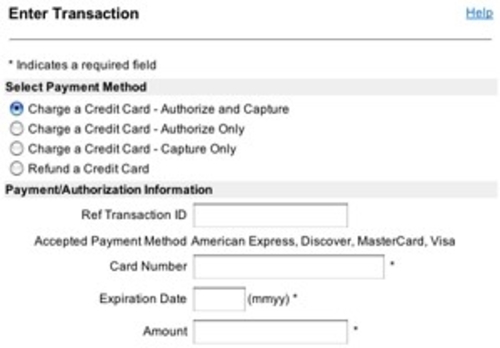

Step 1: Select a Payment Method

- Charge a Credit Card– Select this option to charge an amount to a customer’s credit card. Transactions of this type require the full credit card number, expiration date, and amount. Note: Charge a Credit Card is the default Payment Method.

- Refund a Credit Card – Select this option to return funds to a credit card as a refund for a previously entered, settled transaction. Refunds require the valid gateway-assigned transaction ID of the original transaction, the credit card number and amount. Refunds cannot be submitted for voided, declined, or errored transactions. The amount of the refund should not exceed the amount of the original transaction. If multiple refunds have been issued for the same original transaction, then the sum of all refunds may not exceed the total amount of the original transaction.

The following two options will also appear if you have enabled your account to accept eCheck transactions:

- Debit a Bank Account– Select this option to debit purchase to a customer’s bank account. Debits require a routing number, bank account number, and amount. In addition, these transactions should also include a bank account type (Checking or Savings), and name on the bank account (name of individual or company on file with the bank). (Note: These fields are optional, but we recommend that you include them).

- Refund a Bank Account– Select this option to return funds to a customer’s bank account as a refund for a previously entered transaction. Refunds require the valid gateway-assigned transaction ID of the original transaction, routing number, bank account number (you may include only the numbers that are not masked, ex., 1234, without the Xs; OR the entire number as provided to you directly by the customer), and amount. The Payment Gateway will validate the original transaction ID provided to make sure that it exists and is eligible for a refund. The Payment Gateway will also verify that the bank account number entered for the refund matches the bank account number provided for the original transaction. The amount of the refund may not exceed the amount of the original transaction. If multiple refunds have been issued for the same original transaction, then the sum of all refunds may not exceed the total amount of the original transaction.

Step 2: Select a Transaction Type (optional)

- If you select Charge a Credit Card as your method of payment, you must also specify the transaction type. Select one of the following:

- Authorize and Capture – Transactions of this type will be authorized and automatically submitted for settlement.

- Authorize Only – Transactions of this type are authorized but are not automatically submitted for settlement. These transactions remain in an Authorized/Pending Capture state until a capture action is performed against the transaction. Once a capture action is performed, the transactions will be submitted for settlement. These transactions will expire if they are not captured within 30 days.

- Capture Only – These transactions have been authorized outside of the Payment Gateway. An authorization code is required. Note: Authorize and Capture is the default Transaction Type.

Step 3: View and Enter Transaction Information

- The fields that appear on this page are determined by the settings that you have customized for your account as well as field requirements determined by your processor. All required fields are indicated with an asterisk (*). You must provide a valid value in all required fields in order to submit the transaction. All other fields that appear are optional.

- The sections below describe the most commonly used fields within Virtual Terminal. Additional or fewer fields may also appear on this page based on your Virtual Terminal settings and the requirements of your processor.

Note: We recommend that you use versions 4.5 and higher of either Netscape or Internet Explorer in order to fully utilize this feature.

Payment/Authorization Information

This section describes information associated with the payment method and authorization of the transaction. The fields in this section include:

- Credit Card Number – Credit card number of the customer. The Payment Gateway will only accept card numbers that correspond to the listed card types.

- Expiration Date – Month and year expiration date of the credit card. This should be entered in the format of MMYY. For example, an expiration date of July 2005 should be entered as 0705.

- Amount – Displays the total transaction amount charged to the user’s card.

- Currency – This is the currency for which the amount is authorized.

- Card Code – The three- or four-digit code assigned to a customer’s credit card number (found either on the front of the card at the end of the credit card number or on the back of the card).

- Recurring Billing Transaction – This indicates whether the Payment Gateway should process the transaction as recurring billing.

In the case of eCheck.Net transactions, selecting Debit a Bank Account will display the following fields in this section in addition to Amount and Currency:

- ABA Routing Number – This is the number that identifies the financial institution associated with a customer’s bank account.

- Account Number – This is the customer’s bank account number.

- Bank Account Type – This indicates the type of account, Checking or Savings.

- Bank Name – This indicates the name of the customer’s bank.

Payment/Authorization Information

This section describes information associated with the payment method and authorization of the transaction. The fields in this section include:

- Credit Card Number – Credit card number of the customer. The Payment Gateway will only accept card numbers that correspond to the listed card types.

- Expiration Date – Month and year expiration date of the credit card. This should be entered in the format of MMYY. For example, an expiration date of July 2005 should be entered as 0705.

- Amount – Displays the total transaction amount charged to the user’s card.

- Currency – This is the currency for which the amount is authorized.

- Card Code – The three- or four-digit code assigned to a customer’s credit card number (found either on the front of the card at the end of the credit card number or on the back of the card).

- Recurring Billing Transaction – This indicates whether the Payment Gateway should process the transaction as recurring billing.

In the case of eCheck.Net transactions, selecting Debit a Bank Account will display the following fields in this section in addition to Amount and Currency:

- ABA Routing Number – This is the number that identifies the financial institution associated with a customer’s bank account.

- Account Number – This is the customer’s bank account number.

- Bank Account Type – This indicates the type of account, Checking or Savings.

- Bank Name – This indicates the name of the customer’s bank.

Order Information

This section allows you to input specific information associated with an order or invoice. Fields available in this section are Invoice Number and Description.

Customer Billing Information

This section allows you to enter the customer’s billing information associated with the transaction. Fields available in this section are: Customer ID, First Name, Last Name, Company, Address, City, State/Province, Zip Code, Country, Phone Number, Fax Number, Email Address.

Shipping Information

This section allows you to enter the customer’s shipping information associated with the transaction. Fields available in this section are: First Name, Last Name, Company, Address, City, State/Province, Zip Code, Country, Phone Number.

If the shipping information is the same as the customer billing information, you may also check the box labeled “Same as information entered in Billing Information.”

Additional Details

This section allows you to enter additional details for the transaction such as Tax, Freight, and Duty Amounts, Tax Exempt status, and a Purchase Order Number, if applicable. This information is typically entered to support Level 2 Data requirements for purchase cards.

Step 4: Click Submit.

Step 5: The Payment Gateway will return a response regarding the status of the transaction. If the transaction is approved, you will receive a message indicating that the transaction is approved with a link to more details. If your transaction is declined, you will receive a message indicating that the transaction was declined during authorization. If an error occurs during processing or if your transaction contains invalid data, you will receive an error message.

Trusted By

With over $160 Million in transactions monthly you can trust START to get you the best rates and superior service

Resources

Resources & Articles For Merchant Account Clients

Best Practices for an eCommerce website to avoid fraud

Best Practices For ECommerce Thank you for choosing START Merchant Services as your eCommerce Merchant Account provider. For your Merchant Account to be APPROVED quickly and efficiently, clearly display your contact info, as well as your intended Refund, Exchange,...

Every eCommerce website should do this

Customer disputes and chargebacks are very costly to eCommerce merchants in terms of both time and money. Disputes are time consuming to resolve, and when left unresolved…turn into expensive chargebacks! Chargebacks typically cost $25 per incident, and you will also...

What your website needs to accept credit cards

Thank you for choosing START Merchant Services as your eCommerce Merchant Account provider. In order for your Merchant Account to be APPROVED quickly and efficiently, clearly display your contact info, as well as your intended Refund, Exchange, Warranty and/or...